The COVID-19 pandemic is challenging long-held beliefs in economics and business that people have held for decades. As economies pause and support systems come under strain, returning to "business as usual" looks less possible by the week.

In New Models for a New World, our new series of blog posts, we return to some of our recent project outputs and the lessons they provide for today regarding economic development, sustainability and business opportunities. The COVID-19 pandemic reveals new challenges. GIFT's project outputs provide lessons on how to resolve them.

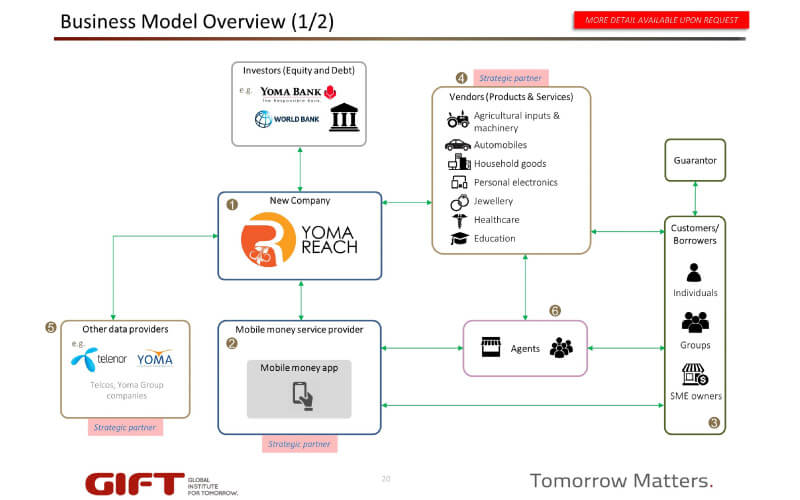

In mid-May, Ant Financial, the world’s largest fin-tech firm and owner of Alipay, invested US73.5 million in Wave Money, the dominant player in Myanmar’s mobile money-transfer space. Wave Money was originally a joint venture between Yoma Strategic Holdings and Norwegian telco Telenor; on June 25th, Yoma purchased Telenor’s stake, turning Wave Money into a Yoma-owned service with significant investment from Ant Financial.

Myanmar has Southeast Asia’s least-developed financial sector. As of 2018, only 25% of people reported owning a bank account. Only 7.1% of firms turned to banks to finance investment plans. There are two reasons: first, formal financial institutions have high requirements for collateral, which tends to limit lending to the most asset-rich of customers and companies; second, a major financial crisis in 2003 led to a decade-long credit crunch and broad mistrust of the banking system, leading to a mostly cash-based economy.

One potential route around these issues is leveraging the internet and the rise of digital devices to expand financial access. 72% of Myanmar’s adult population uses the internet, and 85% of mobile subscribers are smartphone users. The relatively low price of smartphones in Myanmar has led to deep and rapidly expanding smartphone penetration; this has opened up the space for digital financial firms like Wave Money to fill gaps in Myanmar’s current financial system.

Wave Money is a digital money-transfer service. Through the Wave Money application, users can transfer money to their contacts, whether or not the payee is a Wave Money accountholder. To either make a payment or top-up their digital account, Wave Money users go to an agent — often the owner of a micro- or small-sized enterprise — and submit payment in cash; the agent then confirms the transaction. The same process happens in reverse when someone wants to convert a Wave Money payment into cash: they approach an agent, show proof that a payment was made, and the agent converts it into cash.

While Wave Money’s main business is money-transfer, they have started to slowly expand the services they offer. Late in 2019, Wave Money, in a partnership with Yoma Bank, began to offer uncollateralized loans to its agents to help them resolve short-term cash-flow issues.